Last Update 15 hours ago Total Questions : 516

The Business Knowledge for Internal Auditing content is now fully updated, with all current exam questions added 15 hours ago. Deciding to include IIA-CIA-Part3 practice exam questions in your study plan goes far beyond basic test preparation.

You'll find that our IIA-CIA-Part3 exam questions frequently feature detailed scenarios and practical problem-solving exercises that directly mirror industry challenges. Engaging with these IIA-CIA-Part3 sample sets allows you to effectively manage your time and pace yourself, giving you the ability to finish any Business Knowledge for Internal Auditing practice test comfortably within the allotted time.

The budgeted cost of work performed is a metric best used to measure which project management activity?

When executive compensation is based on the organization's financial results, which of the following situations is most likely to arise?

In accounting, which of the following statements is true regarding the terms debit and credit?

Which of following best demonstrates the application of the cost principle?

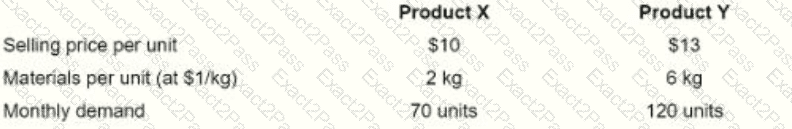

An organization produces products X and Y. The materials used for the production of both products are limited to 500 Kilograms

(kg ) per month. All other resources are unlimited and their costs are fixed. Individual product details are as follows in order to maximize profit, how much of product Y should the organization produce each month?

$10 $13

2 kg

70 units

6 kg

120 units

Which component of an organization's cybersecurity risk assessment framework would allow management to implement user controls based on a user's role?

Following an evaluation of an organization's IT controls, an internal auditor suggested improving the process where results are compared against the input. Which of the following IT controls would the Internal auditor recommend?

Which of the following statements describes the typical benefit of using a flat organizational structure for the internal audit activity, compared to a hierarchical structure?

Which of the following statements is true regarding an investee that received a dividend distribution from an entity and is presumed to have little influence over the entity?

Which of the following characteristics applies to an organization that adopts a flat structure?

Management is pondering the following question:

"How does our organization compete?"

This question pertains to which of the following levels of strategy?

Which of the following purchasing scenarios would gain the greatest benefit from implementing electronic data interchange (EDI)?