CLIENT INFORMATION FORM Client Name: ABC Tech Corp Client ID. Number: 08125 Name: ABC Tech Corp Registered Address: Mumbai, India Work Address: Mumbai, India Cell Phone: "*•"'" Alt Phone: "*""* Email: ........"

Client Profile Information:

Sector: Financial

Engaged in business from (date): 02 Jan 2020 Sub-sector: Software-Cryptocurrency Exchange Expected Annual Transaction Amount: 125,000 USD Payment Nature: Transfer received from clients’ fund

Received from: Clients

Received for: Sale of digital assets

The client identified itself as Xryptocurrency Exchange." The client has submitted the limited liability partnership deed. However, the bank's auditing team is unable to identify the client's exact business profile as the cryptocurrency exchange specified by the client as their major business awaits clearance from the country's regulator. The client has submitted documents/communications exchanged with the regulator and has cited the lack of governing laws in the country of their operation as the reason for the delay.

During the financial crime investigation, the investigator discovers that some of the customer due diligence (CDD) documents submitted by the client were fraudulent. The investigator also finds that some of the information in the financial institution's information depository is false. What should the financial crime investigator do next?

Due to an ever-diversifying business model and multi-jurisdictional footprint, a casino has decided to outsource the source of funds and wealth checks to a third-party provider. Why is it important for the casino to maintain control of the output from the provider?

An investigator receives an alert documenting a series of transactions. A limited liability corporation (LLC) wired 59.000,000 USD to an overseas account associated with a state-run oil company. A second account associated with the state-run oil company wired 600,000,000 USD to the LLC. The LLC then wired money to other accounts, a money brokerage firm, and real estate purchases.

The investigator initiated an enhanced KYC investigation on the LLC. The financial institution opened the LLC account a couple of weeks prior to the series of transactions. The names associated with the LLC had changed multiple times since the account opened. A search of those names revealed relations with multiple LLCs. Public records about the LLCs did not show any identifiable business activities.

Open-source research identified mixed reports about the brokerage firm.

The firm indicated it purchased mutual funds for its clients and dispensed returns to clients.

Media reports claimed the firm laundered money by holding money for a fee before returning it to investors.

Which information should the investigator review first when examining the wire transaction documentation?

Which test should be included in a bank's Office of Foreign Assets Control sanctions screening audit program?

How does the Financial Action Task Force (FATF) measure the effectiveness of a country's efforts to combat money laundering and terrorist financing?

A KYC specialist from the first line of defense at a bank initiates an internal escalation based on a letter of credit received by the bank.

MEMO

To: Jane Doe. Compliance Manager, Bank B From: Jack Brown, KYC Specialist, Bank B RE: Concerning letter of credit

A letter of credit (LC) was received from a correspondent bank. Bank A. in Country A. in Asia with strict capital controls, providing guarantee of payment to Bank B's client for the export of 10 luxury cars located in Country B. located in Europe. Bank A's customer is a general in the army where Bank A is headquartered.

The information contained in the LC is as follows:

• Advising amount per unit 30.000.00 EU •10 units of BMW

• Model IX3

• Year of registration: 2020

Upon checks on Bank B's client, the exporter mentioned that the transactions were particularly important, and a fast process would be much appreciated in order to avoid reputational damage to the firm and the banks involved in the trade finance process. The exporter has a longstanding relationship with Bank B and was clearly a good income generator. The exporter indicated that, as a general, the importer was trustworthy.

The relationship manager Feedback from the RM: The RM contacted the exporter for a client courtesy visit, but it was rearranged four times as the exporter kept cancelling the appointments. When the exporter was finally pinned down for an interview, employees were reluctant to provide clear answers about the basis of the transaction. The employees were evasive when asked about the wider business and trade activity in the country. Findings from the investigation from various internal and external sources of information: • There were no negative news or sanctions hits on the exporter company, directors, and shareholders. • The registered address of the exporting business was a residential address. • The price of the cats was checked and confirmed to be significantly below the market price of approximately 70,000 EU, based on manufacturer's new price guide. • The key controllers behind the exporting company, that is the directors and During the investigation, the investigator determines that a nephew of the general (Bank A's customer) is a customer at Bank B. Which step should the investigator take next?

A country that does not have strong predicate offenses and is lax in prosecuting AML cases could suffer which social/economic consequence?

In which case should an investigator avoid escalating a suspicious event to the chief compliance officer and pursue other channels?

An analyst reviews an alert for high volume Automated Clearing House (ACH) activity in an account. The analyst's initial research finds the account is for a commercial daycare account that receives high volumes of large government-funded ACH transactions to support the programs. The account activity consists of checks (cheques) made payable to individual names in varying dollar amounts. One check indicates rent to another business.

An Internet search finds that the daycare company owner has previous government-issued violations for safety and classroom size needs, such as not having enough chairs and tables per enrollee. These violations were issued to a different daycare name.

Simultaneous to this investigation, another analyst sends an email about negative news articles referencing local child/adult daycare companies misusing governmental grants. This prompts the financial institution (Fl) to search all businesses for names containing 'daycare' or •care'. Text searches return a number of facilities as customers at the Fl and detects that three of these businesses have a similar transaction flow of high volume government ACH funding with little to no daycare expenses.

Which red flags would be an indicator that activity is connected to a corruption/bribery typology? (Select Two.)

The intended benefits of section 314(b) of the USA PATRIOT Act include: (Select Three.)

How does the Asian/Pacific Financial Action Task Force

An investigator at a bank triggered a review in relation to potential misuse of legal persons and a complex network of corporate entities owned by customer A. For the investigator to provide a holistic view of the underlying risk, which action should be the initial focus of the investigation?

Which reputations risk consequence could a financial entity face for violating AML laws?

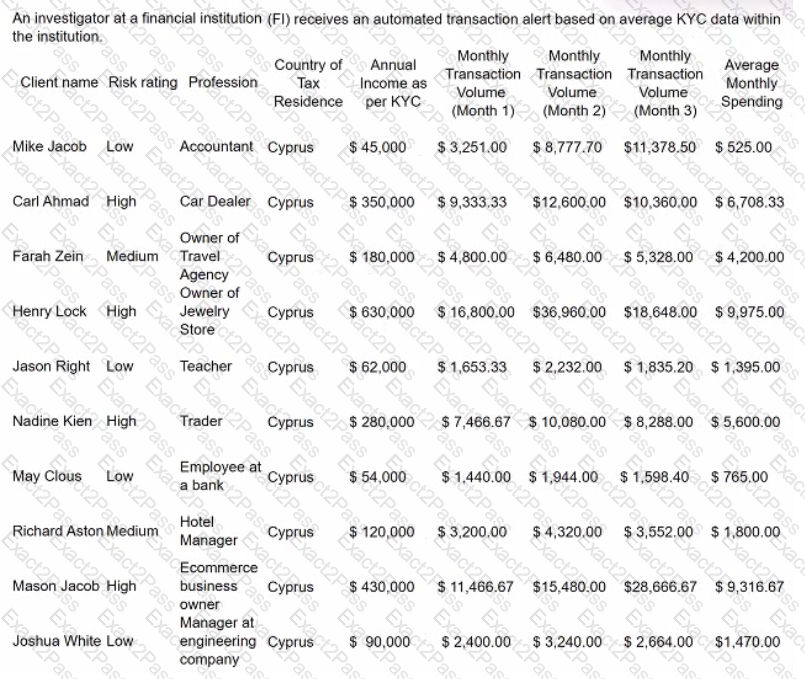

During a review of the accounts related to Richard Aston, an investigator notices a high number of incoming payments from various individuals. They also notice that these incoming payments typically occur during large sporting events or conferences. As a result of the account review, of which illegal activity does the investigator have reasonable grounds to suspect Richard Aston?

In the past 6 months, a small financial institution (Fl) has received regular remittances that are increasing in value from a country with high piracy activity. The Fl's AML officer (AMLO) has also noted that piracy in this country has increased in the same time frame. Which recommendation should the AMLO make?

A financial institution (Fl) banks a money transmitter business (MTB) located in Miami. The MTB regularly initiates wire transfers with the ultimate beneficiary in Cuba and legally sells travel packages to Cuba. The wire transfers for money remittances comply with the country's economic sanctions policies. A Fl investigator on the sanctions team reviews each wire transfer to ensure compliance with sanctions and to monitor transfer details.

An airline located in Cuba, unrelated to the business, legally sells airline tickets in Cuba to Cuban citizens wanting to travel outside of Cuba. The airline tickets are purchased using Cuban currency (CUC).

The MTB wants 100,000 USD worth of CUC. Purchasing CUC from a Cuban bank includes a 4% fee. The MTB contacts the airline to ask if the airline will trade its CUC for USD at a lower exchange fee than the Cuban bank. The airline agrees to a 1% fee. The MTB initiates a wire transfer to the airline which appears as normal activity in the monitoring system because of the business' travel package sales.

The investigator recommends that a SAR/STR be filed. What documentation should be referenced in the SAR/STR filing? (Select Three.)

An analyst reviews an alert for high volume Automated Clearing House (ACH) activity in an account. The analyst's initial research finds the account is for a commercial daycare account that receives high volumes of large government-funded ACH transactions to support the programs. The account activity consists of checks (cheques) made payable to individual names in varying dollar amounts. One check indicates rent to another business.

An Internet search finds that the daycare company owner has previous government-issued violations for safety and classroom size needs, such as not having enough chairs and tables per enrollee. These violations were issued to a different daycare name.

Simultaneous to this investigation, another analyst sends an email about negative news articles referencing local child/adult daycare companies misusing governmental grants. This prompts the financial institution (Fl) to search all businesses for names containing daycare' or 'care1. Text searches return a number of facilities as customers at the Fl and detects that three of these businesses have a similar transaction flow of high volume government ACH funding with little to no daycare expenses.

During the investigation, it was determined that some of the checks were issued to a mother-in-law of a PEP and deposited into her account with the Fl. This customer was not found on the Fl's PEP list How should the investigator proceed in this situation"? (Select Two.)

A client with many personal and business deposits with the financial institution (Fl) seeks a business loan. The client wants to guarantee the loan with a trust for which they are the beneficiary.

An investigator examines the trust. The trust has many layers, including shell companies in known tax havens. The client's ultimate beneficial ownership claim cannot be validated, and the loan is denied.

Two months later, the Fl receives a law enforcement (LE) request on one of the client's business accounts. While reviewing the business account, the Fl receives another LE request on the same account from another agency. The requested information is shared.

Three months later, a branch manager receives a request to open a business deposit account related to a complex trust. The manager forwarded the request because of the complexity. The trust was the same as the previously examined trust, but the request came from a different client. The second client also has many accounts with the Fl. Further inspection finds links between the second client and the Paradise Papers. The Papers state the client led illegal activities and committed tax evasion.

What steps should the investigator take to review the accounts held by the second client who is listed in the Paradise Papers? (Select Two.)

Which payment method for purchasing luxury items is a red flag for potential money laundering?

The law enforcement agency (LEA) of a foreign jurisdiction contacts a financial institution (Fl) regarding one of the Fl's clients. The LEA advises that the client is currently wanted for prosecution as a result of a series of human trafficking charges. What should the Fl do? (Select Two.)

When crafting internal procedures on writing and submitting SARs/STRs, one should:

A SAR/STR on cash activity is filed for a company registered in the Marshall Islands operating a Mediterranean beach bar and hotel. The company has three nominee directors, one nominee shareholder, and another individual declared as both the beneficial owner and authorized signatory. Which information is key for law enforcement's physical surveillance of cash activity? (Select Two.)

As part of an internal fraud investigation, an AML officer has decided to interview an employee. Which statement is most consistent with best practices?

During transaction monitoring. Bank A learns that one of its customers. Med Supplies 123, is attempting to make a payment via wire totaling 382.500 USD to PPE Business LLC located in Mexico to purchase a large order of personal protective equipment. specifically surgical masks and face shields. Upon further verification. Bank A decides to escalate and refers the case to investigators.

Bank A notes that days prior to the above transaction, the same customer went to a Bank A location to wire 1,215,280 USD to Breath Well LTD located in Singapore. Breath Well was acting as an intermediary to purchase both 3-ply surgical masks and face shields from China. Bank A decided not to complete the transaction due to concerns with the involved supplier in China. Moreover, the customer is attempting to send a third wire in the amount of 350,000 USD for the purchase of these items, this time using a different vendor in China. The investigator must determine the next steps in the investigation and what actions, if any. should be taken against relevant parties.

The investigator is gathering more information to determine if a SAR/STR filing is needed. Which steps are the correct ways of collecting the additional information? (Select Two.)

According to the Financial Action Task Force, as part of their risk assessment, which are important data and information that a Trust and Company Service Provider must understand when establishing and administering a trust? (Select Two.)

During a review, an analyst notices discrepancies between a customer's nature of business listed on the business registry and what was stated on the customers application. The analyst should:

During transaction monitoring. Bank A learns that one of their customers. Med Supplies 123, is attempting to make a payment via wire totaling 382,500 USD to PPE Business LLC located in Mexico to purchase a large order of personal protective equipment. specifically surgical masks and face shields. Upon further verification. Bank A decides to escalate and refers the case to investigators.

Bank A notes that, days prior to the above transaction, the same customer went to a Bank A location to wire 1,215,280 USD to Breath Well LTD located in Singapore. Breath Well was acting as an intermediary to purchase both 3-ply surgical masks and face shields from China. Bank A decided not to complete the transaction due to concerns with the involved supplier in China. Moreover, the customer is attempting to send a third wire in the amount of 350,000 USD for the purchase of these items, this time using a different vendor in China. The investigator must determine next steps in the investigation and what actions, if any. should be taken against relevant parties.

Upon further investigation. Bank As investigator learns that both the Mexico- and Singapore-based companies are linked to the alleged suppliers in China. Which additional indicators would the investigator need to identify to determine if this fits a fentanyl (drug) trafficking typology? (Select Two.)